This post was inspired by a Twitter exchange with a Culver City resident who was able to shed one of her family's two cars due to the Move Culver City Project to reallocate space from cars to transit (bus lanes), active transportation (walking/biking) and micro-mobility (scooters, wheelchairs).

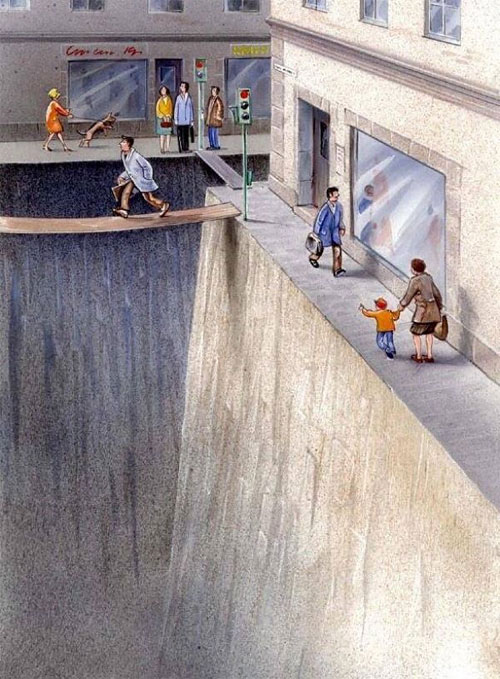

Culver City's city council balance changed from 3/2 in support of this street space reallocation to 3/2 opposed. The new city council wants to reverse the street space allocation and give 100% of the public space to cars again despite the city's own data that transit and bike use grew explosively while car use declined. Read the Move Culver City Mid-Pilot Report.

I think reversing Move Culver City is a big mistake for many reasons, but I will just get into the financial angle in this post.

Car ownership is so normalized in US society that I think we stop paying attention to how much it's really costing us. When AAA published their annual report "How Much Does it Really Cost to Own a New Car 2022", it surprised many people. [2023 Update is even grimmer, $12,182/year]

There were the usual arguments that not everyone buys a new car. But, this assumes the average new car sells for $33,301 when Kelley Blue Book reports that the average car price set a new record in December 2022 at $48,681. Car and Driver reports that Los Angeles drivers pay $681/year more for car insurance than the national average.

$10,728 is an underestimate for the cost to own a car in Los Angeles. That price also does not include the cost of a parking spot, which you are paying for whether it's a line item in your budget or not. Everyone seems to complain about parking, even though Los Angeles has more homes for cars than for people.

If households with multiple cars can shed one car, they can save $10,728/year.

Median Culver City household income in $97,540 with a marginal tax rate (CA+Fed) of 33.3%.

Owning a car costs $16,084/year pre-tax.

If that money were put in a tax-deferred retirement savings account every year for 30 years, that household can accumulate just under $1 Million!

I assumed that the money was saved in a Vanguard Growth and Income Mutual Fund (VGIAX) earning about 6.54% over the last 20 years or 10.78% over the last 10 years.

The Bureau of Labor Statistics CPI inflation calculator says inflation ran 2.65% over the last 20 years.

Using a conservative 4% above inflation estimate for VGIAX, the Bankrate Compound Interest Calculator shows that the household that was able to shed a car winds up with $916,300 after 30 years in their retirement savings account. Yes, you do pay taxes as you withdraw that money, but that's a huge chunk of money nevertheless.

In Summary, if Move Culver City allows families to shed one car, then that is a $1M gift to the families in Culver City.

Reversing/removing the street improvements--making buses too slow to use and bicycling too dangerous to attempt--forces families into cars again. If they have to own a second car again, then Culver City families lose $1 M.

Elected officials should think long and hard about whether they want to force car dependency and costs onto their residents. It's not good for residents, it's not good for the planet, it's not good for the city. Finally, I don't think it's good for the elected officials' ability to get re-elected.

No comments:

Post a Comment

Comments are open for recent posts, but require moderation for posts older than 14 days.